accumulated earnings tax reasonable business needs

This taxadded as a penalty to a companys income tax liabilityspecifically applies to the companys taxable income less the deduction for dividends paid and a standard accumulated. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation.

Business Income And Business Taxation In The United States Since The 1950s Tax Policy And The Economy Vol 31 No 1

Accumulated Earnings Tax IRC 531 The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable.

. The Tax Code defines. Specific and feasible plan to develop a stock. Have been accumulated for the reasonable needs of the business or beyond such needs is dependent upon the particular circumstances of the case.

The tax is assessed at the highest individual tax rate. For a business to avoid this tax it must demonstrate that the profits carried forward do not exceed the limits of reasonable business needs. Once again the tax can be levied if the IRS.

The accumulated earnings tax. 1 Accumulated taxable income is. The accumulated earnings tax imposed by section 531 shall not apply to.

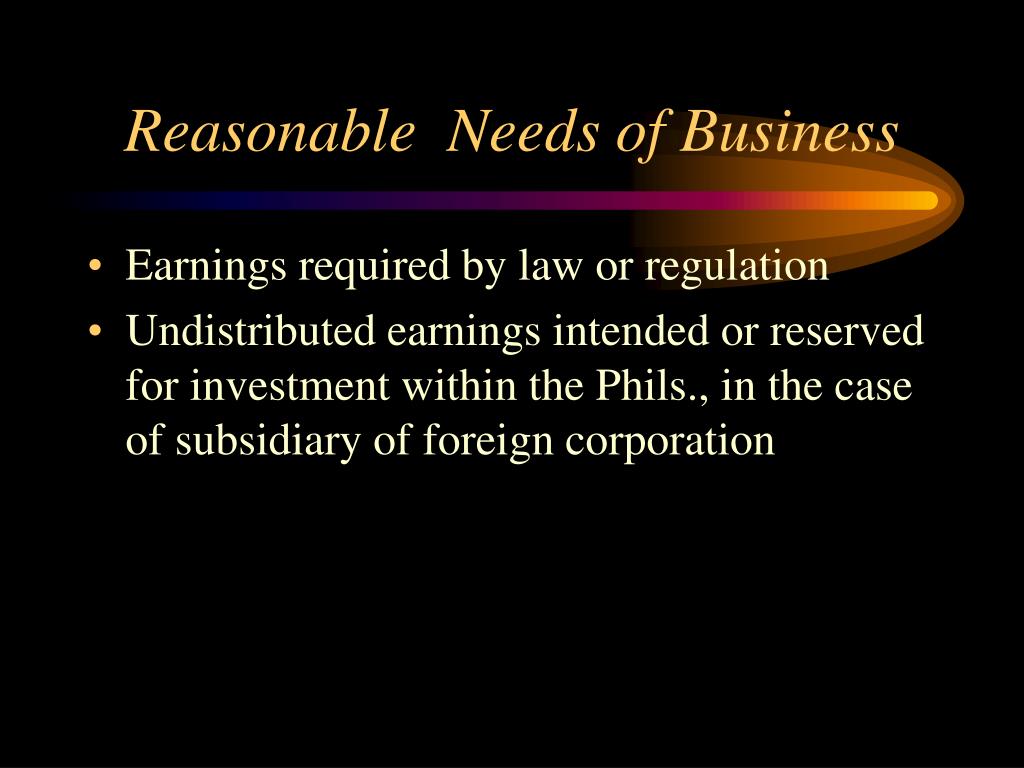

The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business. A General rule For purposes of this part the term reasonable needs of the business includes 1 the reasonably anticipated needs of the business 2 the section 303 redemption needs of. Trol is shifted The crucial issue for purposes of the tax on accumulated earnings is whether the accumulation should be characterized as under-taken for the corporations reasonable.

Reasonable business needs versus tax avoidance by Machinery and Allied Products Institute 1967 edition in English It looks like youre offline. The key term reasonable needs of the business. The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business.

The accumulated earnings tax doesnt apply to earnings kept in the business to meet the reasonable needs of the business. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax. The purpose of accumulated earning tax is to discourage the accumulation of profits if the purpose of such accumulation is to enable shareholders to avoid paying taxes on those profits.

1537-2a Income Tax. The IRS regulations provide some broad criteria that can be used to justify that earnings are being accumulated for reasonable business needs. The fact that the earnings and profits of a corporation are permitted to accumulate beyond the reasonable.

Expansion of the business acquisition of a business retirement of debt to provide the appropriate level of. Essentially the accumulated earnings tax is a 15. Which of the following would not be considered a reasonable need of a business in determining the accumulated earnings tax.

Regulations support that the following business needs are reasonable. An accumulation of the earnings and profits including the undistributed earnings and profits of prior years is in excess of the reasonable needs of the business if it exceeds the amount that.

Accumulated Earning Tax On Corporations Accumulated Profits

Strategies For Avoiding The Accumulated Earnings Tax Krd Ltd

Solved The Accumulated Earnings Tax Is Effectively A Penalty Chegg Com

Determining The Taxability Of S Corporation Distributions Part I

Chapter 10 Study Quiz Docx Chapter 10 Study Quiz 1 2 3 4 Which Of The Following Is A Partnership A Jim And George Buy And Operate A Gas Station Course Hero

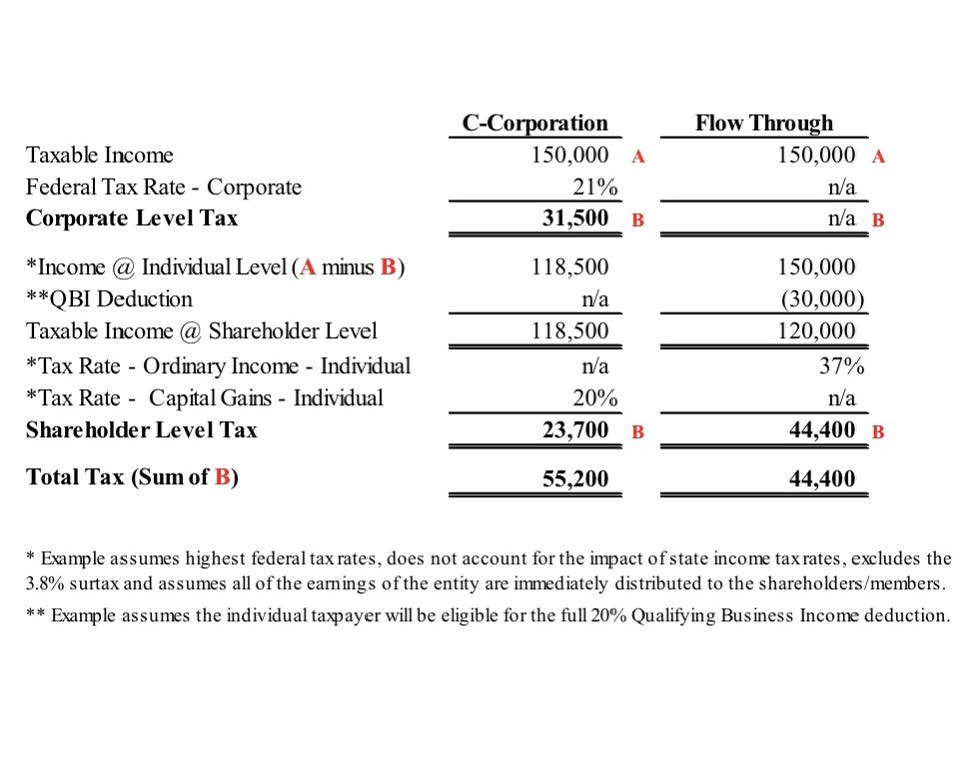

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

Ppt Improperly Accumulated Earnings Tax Iaet Ra 8424 Rr 2 2001 Powerpoint Presentation Id 3510186

Is Corporate Income Double Taxed Tax Policy Center

Tax Geek Tuesday Computing Earnings And Profits

What Is The Accumulated Earnings Tax Kershaw Vititoe Jedinak Plc

Tax Implications Of Llcs Amp Corporations Wolters Kluwer

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

A Beginner S Guide To C Corporation Distributions Henssler Financial

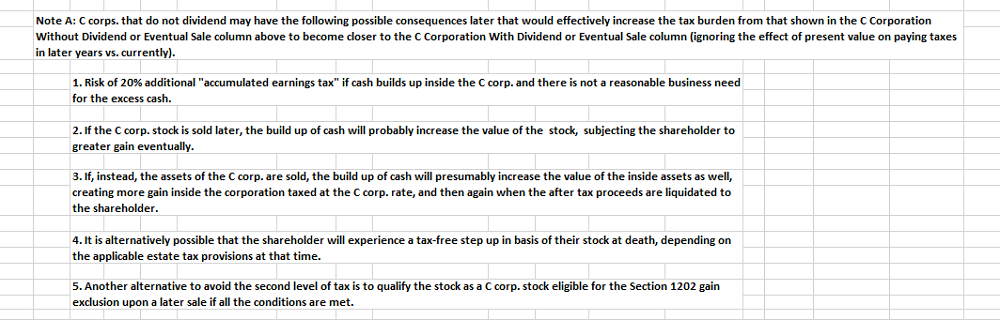

How Corporations May Run Afoul Of The Accumulated Earnings Tax A Section 1202 Planning Brief Frost Brown Todd Full Service Law Firm

Darkside Of C Corporation Manay Cpa Tax And Accounting

Irs Use Of Accumulated Earnings Tax May Increase

Tax Considerations When Making A Choice Of Entity In Pa